Category: Budgeting & Money Management

I’m in my car. On my way to work. Listening to the radio. And one commercial catches my attention.

A lady comes home with a shopping bag. Her husbands asks what’s in it and then exclaims, “Don’t you have enough dresses?” (Like that’s actually possible). She replies, “But honey, they were 70 percent off”. He pauses and then replies, “That’s a lot.” In reality, this is a general perception. If it’s on sale and I’m getting such a great bargain, I should buy this.

We have a weekly tradition in our household. Every week, assuming they have earned it, we stop at the local convenience store, where my kids get to pick out a movie. We head to the non new-release section. Its a great deal. A 3 day rental for 2.00. The kids get an entire weekend of entertainment (assuming they have time to watch the movies. And if they don’t, it’s only 4 bucks.)

If you step back and look at your finances, you will find that you are in one of three stages of financial being – The first stage is “survival mode”. The next stage is the “breathing room” stage. The third stage, which is where we all strive to be, is the “comfort zone”.

Trimming your budget is a lot like trimming your waistline. Consumers spend millions of dollars every year looking for that magic solution to losing weight. And businesses increase their bottom line while relatively few consumers decrease their bottoms/middles etc. The same phenomenon happens in money management. We tend to look for quick fixes – consolidation loans, second mortgages, payday loans. Neither works for the masses. Why? They do nothing to address the underlying problem…

It’s been six long months and my hands are cleaner than ever. Who would have thought I would make it this far? I am referring to life without a dishwasher. Around mid-December, ours broke. My first reaction was sheer terror. I’m pretty sure I almost lost consciousness. Like many families struggling to make ends meet, I didn’t have any savings to buy another. The word credit kept flashing in my mind, but we were just managing what we had. I took a deep breath, pulled up my rubber gloves, and started washing.

{“You have got to feel good about money to attract more to you. Understandably, when people do not have enough money they do not feel good about money, because they don’t have enough. But those negative feelings about money are stopping more money coming to you! You have to stop the cycle, and you stop it by starting to feel good about money, and being grateful for what you have. Start to say and feel, “I have more than enough.” “There is an abundance of money and it’s on it’s way to me.” “I am a money magnet.” “I love money and money loves me.” “I am receiving more money every day.” “Thank you. Thank you. Thank you.”}

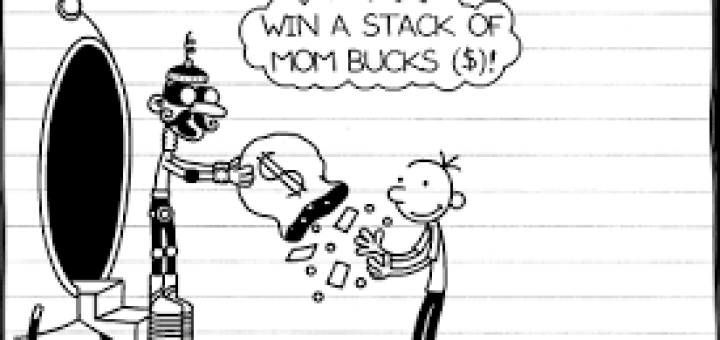

Isn’t it wonderful? There is absolutely no reason to wait for something you can’t afford now. And the deal is much better than buying it on regular credit that has to be paid starting next month. Ah! what a wonderful consumer-driven world we live in.

It’s also dangerous. In fact, it’s a trap – a credit trap. The objective is to have you commit future income towards the purchase of something you just can’t (don’t want to) wait for. We are such an impatient society aren’t we? Wait! It gets better – you are further tempted (expected) to spend more than you normally would on the item(s) AND the gamble is that you won’t pay it off completely by the time it comes due.