5 Reasons Why you Should Track Your Expenses

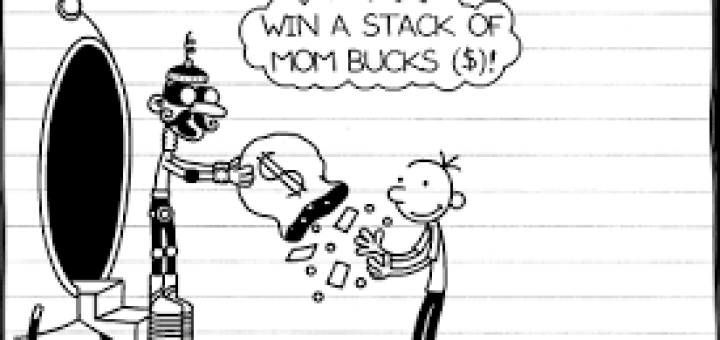

Keeping track doesn’t have to be painful. You want to find a system that works for you, something not too complicated. You don’t have to track expenses for the rest of your life, but hopefully, you will realize the value, as I have, and want to make it part of your financial plan.