Navigating the Fee Infested Waters of Debt Counselling

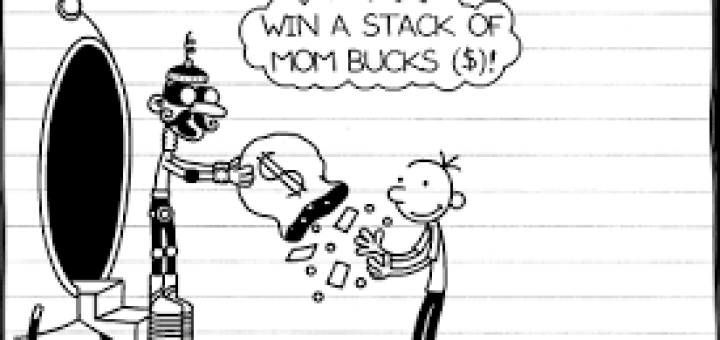

There is a disturbing trend happening in the Credit Counselling Industry. Companies are popping up online with toll free numbers, promises of reduced interest rates and manageable monthly payments.